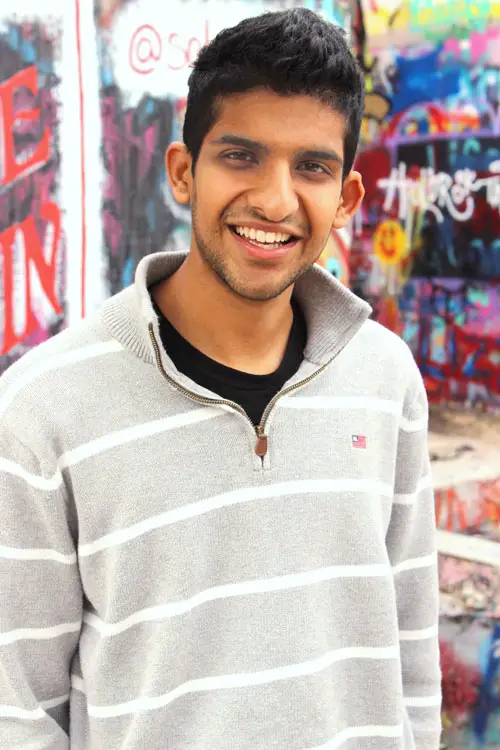

Investing in start-ups used to be the domain of the fabulously wealthy—$2 million net worth or $200,000 annual income only, please and thank you, but Rohan Shah is here to change that. Shah, a rising junior at the University of Pennsylvania, wants to ensure that every average Joe is afforded the same opportunity to invest in start-ups as the 1 percent.

In a scene full of white tech bros from Silicon Valley, Shah is a breath of fresh air. Using money he made from mining BitCoin in high school and investments from Rough Draft Ventures, the Philly-based Computational Finance major founded a company called Slice Capital, an equity crowdfunding platform that allows non-accredited investors to invest in pre-vetted start-ups.

Shah and his team created an app for Slice Capital that made waves everywhere from the Forbes 30 Under 30 competition, CNBC, “Inc Magazine,” “The Boston Globe” and the “New York Business Journal.” With his company and app, Shah not only seeks to democratize the start-up investing process, but also to select a more diverse group of start-ups to be invested in and expand start-up hubs to formerly overlooked cities. With a track record of winning numerous hackathons, being the first high school age PennApps Fellow and developing tracking software later purchased by the U.S. Navy, it’s hard to believe he’ll be anything but successful.

Giselle Krachenfels: So before we talk about Slice Capital, I’d like to hear about your background from your younger years. Were you always invested in finance and start-ups?

Rohan Shah: Oh yes, very much so. I grew up in a household where finance and business in general were very present. We’d always have CNBC or Bloomberg Television running in the background, so I picked up on all of this stuff. From a very young age I started investing in a variety of asset classes, whether it was stocks, commodities or even bitcoin.

GK: I read that you’ve been in the hackathon scene since sophomore year of high school, can you tell me about it?

RS: That’s also one of the reasons why this whole start-up route was very familiar. I was one of the first one hundred high school hackers in the nation. Throughout high school I went to a number of different hackathons and won a number of them, such as at PennApps, CalHacks and HackTech.

These experiences were really my first dive into the whole tech and entrepreneurship space, and I actually met a lot of my team at hackathons. For example, Dan Stepanov, my co-founder, and I met about five years ago at a hackathon. The hackathon scene is very near and dear to my heart, and I owe a lot of where I am today to my early entrance into that space.

GK: Can you elaborate on your gap year?

RS: I worked for a company called PointOne Development, and we focused on developing algorithms to help figure out where something is based on an initial point of interest, even if there’s no GPS signal at the time. We used a bunch of sensors, such as gyroscopes, accelerometers and compasses, to figure out, based on an initial location, where you end up, without the need for GPS reception. The U.S. Navy then approached us and said that they were interested and had a use for the technology and algorithms we developed. They acquired the intellectual property, and that was our exit. The Navy has a huge fleet of ships, but there are a bunch of GPS dead spots at sea. So, essentially, they utilize our algorithms so even if there isn’t GPS reception, they’re able to know exactly where their ships are at any given time.

GK: What else are you involved with, in or outside of school?

RS: I’m involved with a number of clubs at Penn related to the entrepreneurial scene. I’m on the board of Founders Club, Work in FinTech and I’m the president of PennApps Fellows, a spinoff of PennApps. I’m also on a dance team at Penn called Penn Dhamaka, an all-guys dance team.

GK: Okay, so now that we know a little bit about you, can tell me about how Slice Capital came to be?

RS: Let me preface this by saying that venture capital, as it exists today, is very, very skewed. For example, 97 percent of all the venture capital funding, around $30 billion, went to white, male CEOs. That’s not to say that white, male CEOs do a bad job, but if that is the allocation of capital to any group, there’s obviously something wrong.

Additionally, half of that capital went to companies in California. There are a lot of great start-ups in Philadelphia that are underserved from not only a talent standpoint, but also a funding standpoint. There are a lot of underserved companies in Missouri and Nebraska, and all of these “flyover states” just don’t get access to the same opportunities. At the end of the day, if you don’t have funding, your company isn’t going to be able to take off.

As I dove deeper into the potential of who Slice Capital could reach, the statistics are mind boggling. Not only is the allocation of capital extremely skewed as is, as I talked about earlier, but there’s an enormous market. The amount of accredited investors in the U.S. is about 2.6 million people. This seems like a lot, but isn’t really, given the population size. There’s an opportunity to reach hundreds of millions additional investors. You could say that “Yeah, well they’re not worth as much, they won’t be able to contribute as much as all the VCs and angels that invest today,” but that’s not true. If you look at the amount of liquid assets that the non-accredited 99 percent have in their accounts, it’s $30 trillion. Even taking just 1 percent of that is $300 billion, which is ten times the amount of venture capital that was invested last year. So there was an enormous potential to open up the floodgates.

GK: Why did you start Slice?

RS: After learning a lot of these statistics, in conjunction with my past involvement with investing and the hackathon scene, was how it began. Start-ups have always been a large portion of what I enjoy reading about, and a large part of my life in general. It’s a very natural intersection—I always read about these amazing things being done in the start-up space, but I haven’t personally been able to invest in them. I’m not an accredited investor, I don’t have $2 million in net worth and I don’t have an annual income of $200,000 or more. Up until now, investment has been limited to the 1 percent. So one of the reasons I started Slice is I guess what you could call a selfish reason—I wanted to be able to invest in these incredible companies that I read about.

I also wanted to democratize the process, and my theory of democratizing it and giving power to the people, per say, has actually been proven in some of the countries where equity crowdfunding is starting to be more impactful than the traditional VC and angel investing. I think that there’s a huge potential for this, and in today’s market, a platform where people can go and invest in start-ups didn’t really exist. We did a lot of surveys and focus groups with people twenty-two to forty years old, and 85 percent of these people didn’t even know that equity crowdfunding platforms exist. The fact that people don’t know they’re able to get into this asset class is an issue.

GK: What does Slice Capital provide that’s different from the competition?

RS: One of the big things we provide is portfolio diversification. Any Investing 101 class will tell you that portfolio diversification is how you mitigate risk, and venture capital and early-stage investing are pretty risky assets classes. A traditional venture capital firm can look at two thousand pitches and then choose one hundred companies they see as promising for investment. Five to seven years down the road, a handful of the companies will really outperform the rest of the portfolio and make up for the losses of the others.

Competing companies expect that out of the one hundred companies that they put on the platform, the non-accredited, often less finance-savvy investors will be able to pick out the handful of companies that will outperform the others. We think that’s very wrong. For this reason, we help our users create a very diversified portfolio. The way we created our user experience is that users have to invest in at least five to ten companies.

GK: How did you raise the money needed to get Slice Capital off the ground?

RS: A lot of our funding came from BitCoin, and then some outside funding. In high school, I was able to mine BitCoin, and then I sold it on one of the secondary markets in exchange for U.S. dollars.

In terms of outside funding, we’re not just here to win competitions; we want to build a product and make a difference. But early on, it’s a good way to get some funding. We entered the Forbes 30 under 30 competition and they asked us to come to Boston to pitch it. We were runners-up, and General Catalyst ending up investing in us.

GK: How do you vet start-ups that are interested in working with Slice Capital?

RS: Let’s go back to the statistic of 97 percent of funding going to white males in California. Obviously there is a subconscious bias that exists in the vetting process in general; we want to eliminate this subconscious bias. The way we’re doing that is by building an algorithm and using a very data-driven process in order to narrow down our deal flow.

What this means is that instead of having humans go through thousands of different companies, we have a computer look at a company’s various data—revenue, profits, tax returns, etc.—and it sees within a high degree of confidence per dollar we invest in this company, how many dollars can we expect to get in return.

The process of conducting due diligence is not something a computer can do completely, though. Along with this algorithm and data-driven process, we can narrow down our funnel to 30 to 40 percent of the companies interested. For that remaining percentage, we have humans look at the companies, because given that they’re earlier stage companies, a lot of it is inherently a bit subjective. We look at their team, education, market size and a number of other different factors.

GK: I wasn’t aware of other tech companies using this process before, is it individual to Slice Capital?

RS: This is actually becoming more common—many of the larger VC funds are doing similar processes—but our individual process is quite unique. Our approach is a new thing, and we’re very proud of it. The other thing to note is we’re basing a lot of our due diligence process off of a book called “Early Exits,” written by Basil Peters.

GK: What do you see in the future for the company?

RS: I see us as almost rivaling the NASDAQ or S&P 500, where everyday individuals have the exact same opportunities to invest in the biggest or smallest companies. Take the stock market—the stock market is what currently exists for normal people to invest in publicly traded companies. I want Slice Company to be like that, except prior to the time a company IPOs. I want people to have equal access to investments, rather than having that opportunity held off for the select few.

GK: Where do you see yourself in the future? What are you looking to be involved with after college?

RS: I don’t think it makes sense to think more than six months to a year in advance. It’s good to have dreams and aspirations, but you never want to get too caught up in that. I believe that everything happens for a reason, and I think that everything will work out the way it should. I like to focus on living in the moment, having a good time, surrounding myself with amazing people and enjoying life.