All Majors are Equal, but Some Majors are More Equal than Others

Obama’s new College Scoreboard website ranks majors using financial information such as debt levels and salaries, but is that a good idea?

By Emilio Hidalgo, University of Texas at San Antonio

“What’s your major?”

In a lot of ways, it’s the question that defines your college career—‘what do you plan on doing for the rest of your life,’ essentially.

But once you’re in college, it’s easy to forget how important that question is to the college-application process. Many people pick schools based entirely on what they plan on choosing as their major, and since the college you attend influences the rest of your life (people, classes, opportunities), that means choosing your major—in high school, as an eighteen year old—can be one of the biggest decisions of your life.

In a perfect world, you pick a job you want, find a school that offers that degree plan, go there, graduate, and then live out the rest of your days in bliss.

But last month, the government complicated this seemingly simple process. And by complicated, I mean provided information that revealed the complexity behind what seemed simple. Classic government.

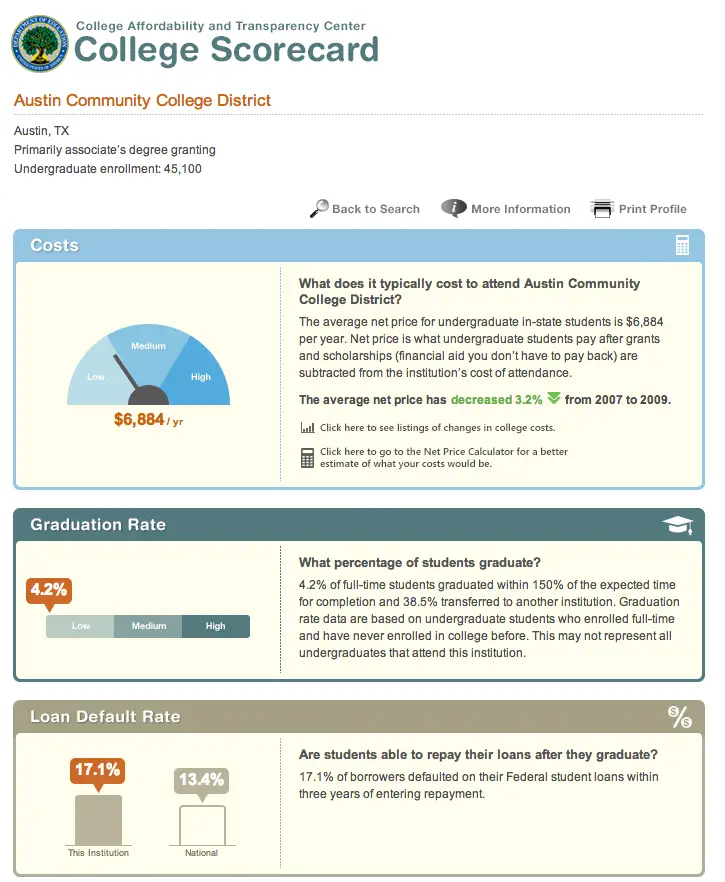

The website offers information about student costs, loans and the potential earning power of different majors. In the words of the U.S. Department of Education, the website aims to provide students with data that can give them more “bang for your educational buck.” Given that 40 million Americans collectively owe nearly $1.3 trillion in student loans, it doesn’t seem like such a bad idea.

One of the main benefits of the site is its ability to show students debt levels as represented by the major they chose, essentially showing prospective students how much debt they could expect to have if you were to choose that major. Information that anecdotally held water until now—‘Art history? Don’t you want to eat?’—has now been formally quantified. Students can use the site to get a pretty accurate idea of what kind of lives they could expect to lead (financially, at least) depending on the major they choose.

This is welcome information. According to Georgetown University’s Center on Education and the Workforce, millennials makes up 40 percent of the unemployed work force. Generation Opportunity, a conservative nonprofit that advocates for millennials, released their “Millennial Jobs Report” in May, and it showed an encouraging trend, but one couched in negativity.

The unemployment rate of 18-to-29-year olds is 13.8 percent, which is an improvement from its 14.2 percent in January, and impressive advancement from this time last year when it was 15. 4 percent. Millennials are getting jobs!

But not so fast. The national average of unemployment is 5.4 percent, meaning that even though our numbers are improving, they’re still disproportionately bad. And this is all just good old-fashioned unemployment, which fails to recognize underemployment, or chronic underpayment, another issue plaguing anyone born between 1980 and 2000. All of these trends make choosing a “lucrative” major—business, finance, engineering— seem less like a personal choice and more like an economic necessity.

Unfortunately, in the long debate over whether college is about education or job placement, Obama’s new website seems to strongly suggest the second. The new tools allow students to objectively weigh what was formerly a gut decision. The website looks at majors as little more than job-training, which has its benefits.

Students should be able to choose low-paying majors (because we need them!), on the condition that they are fully aware of what kind of future it might entail. Money is not the only deciding factor in choosing your major, but it is indisputably a factor. You should know what kind of financial future you’re getting yourself into, and this website is a valuable tool for learning that.

But, financial literacy and high school students don’t often go hand-in-hand.

Most students applying to college are not supporting themselves, many don’t know their own family’s finances, and they can’t be expected to know what they’re financial situation is going to look like in the future. Put more simply, this kind of information can be more confusing than helpful.

In the words of Sigmund Freud:

“When making a decision of minor importance,” he said, “I have always found it advantageous to consider all the pros and cons. In vital matters, however, such as the choice of a mate or a profession, the decisions should come from the unconscious, from somewhere within ourselves. In the important decisions of personal life, we should be governed, I think, by the deep inner needs of our nature.”

Finances should weigh much less heavily in the college-application process than passion; they are not equal. It is more important to do what you want (and now I realize that my millennial is showing)—it is more important to do something you love than to make money. It is not a binary, nor a mutually exclusive system. You should have a comfortable mix of enjoyment in job and money for comfort, but picking your major should primarily be rooted in who you are and what you like.

When I first graduated high school, a family friend suggested a career in metallurgical engineering—and yes, even the name is confusing. He said steady pay and a shrinking field would guarantee a job, so I looked into it. I had taken engineering classes in high school and had some credits built up, but unfortunately I hate math. After pursuing the major for several years, I changed my mind.

When I first graduated high school, a family friend suggested a career in metallurgical engineering—and yes, even the name is confusing. He said steady pay and a shrinking field would guarantee a job, so I looked into it. I had taken engineering classes in high school and had some credits built up, but unfortunately I hate math. After pursuing the major for several years, I changed my mind.

I began considering becoming a surgeon, but after I talked to a doctor about the lifestyle I realized it wouldn’t be right for me. Not because I couldn’t make the grades, do the work or saw the bones, but because he said that the medical field requires a certain personality type, and that if I didn’t have a need to help others, then it wasn’t the right job for me. Nowhere in the College Scorecard website is that fact presented.

If Obama’s new college ranking site had been around when I was graduating high school, I would have made the same mistakes, but I would have made them for longer. I would have said, ‘I can’t go down to a low-paying major from a high-paying majors—that’s a sign of failure.” An association between lucrative and intelligent can easily arise from the way this information is presented, and I think that’s counter-productive to higher education, as well as poisonous to a society’s frame of reference toward employment.

I refuse to support a higher-learning system that holds job prospects as more important than a well-rounded education, not because jobs are bad, but because that’s not what our university system is designed to produce. We have vocational schools for people who want job training. We have colleges for people who want a higher education.

Plus, as I said, there’s a accurate, if anecdotal awareness of which degrees pay well and which don’t. But these specifics, this kind of ranking of majors by monetary ceiling, I think this specificity and presentation of statistics is more than a high-school senior needs. The website is helpful and should certainly exist so the information is accessible, but parents, guidance counselors and anyone involved with students’ college-application process should be quick to stress that finances are simply one factor in a variety of factors that need to be considered